Filter on: Idea Vault Regional Pulse News & Press Releases Webinar Clear Filter

(Idea Vault Blog) - Buying food is essential, of course, but if you’re not careful, it can also eat into your budget.

Continue Reading

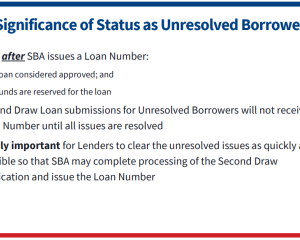

(Laurel Sykes) - We wrote previously about delays in approvals on new PPP loans as a result of the new compliance checks put in place by the SBA to prevent against potential fraud. Just yesterday, the SBA announced a lender training to cover updates to their new Procedural Notice on revised PPP pla…

Continue Reading

(Idea Vault Blog) - Whether you’re standing in front of a shelf at the grocery store, shopping online, or even walking around a car dealership, you may wonder: Do I go for the “nicer,” more expensive option or choose the cheaper one to save some money? At the end of the day, what you’re really deba…

Continue Reading

(Idea Vault Blog) - If you find yourself facing an emergency that you’re financially under-prepared for, the prospect of what to do next may feel overwhelming. Don’t panic. There are things you can do to get through this crisis.

Continue Reading

(Laurel Sykes) - While the need has certainly been no less urgent as small businesses continue to battle stay-at-home orders and local orders for modified operations in accordance with state mandates, the speed at which this latest appropriation of Paycheck Protection Program (PPP) loan funding is…

Continue Reading

(Laurel Sykes) - On Saturday night SBA issued a “reminder” regarding their ability to review PPP loans. SBA’s interim final rule on SBA Loan Review Procedures and Related Borrower and Lender Responsibilities indicates that SBA may review any PPP loan, of any size, at any time. While it is unclear…

Continue Reading

(Idea Vault Blog) - Con artists cheat Americans out of billions of dollars every year. Recognizing red flags for potential scams can help protect you, your loved ones, and your hard earned cash.

Continue Reading

(Laurel Sykes) - The SBA has been busy in the last several weeks, as have lenders participating in the Paycheck Protection Program. SBA issued helpful top-line overviews of key points to both First Draw and Second Draw PPP loans. First Draw loans are available to eligible businesses with up to 500…

Continue Reading

(Idea Vault Blog) - Whether you find yourself laid off from work, facing a medical emergency, or confronted with a situation that you’re financially unprepared for, it may be tempting to withdraw from retirement savings—but there are penalties and consequences you need to consider before doing so.

Continue Reading

(Laurel Sykes) - The media has muddied the waters a bit about whether the SBA has opened its portal for First Draw Loans on January 11 and Second Draw loans January 13 for Community Financial Institutions. Rest assured, the portal is not yet reopened for the majority of PPP lenders, as “Community…

Continue Reading