In today’s fast-paced digital landscape, FinTech, or financial technology, has emerged as a disruptive force in the banking industry. Platforms such as SoFi and Chime have rapidly gained popularity, especially among younger demographics, for their convenient and accessible financial services. Community banks such as American Riviera Bank, however, continue to play an essential role in the financial industry. These local institutions offer a personal touch and a wide range of benefits that cannot be replicated by their digital alternatives. It is beneficial to understand the similarities and differences between FinTech and community banks, as well as the advantages for banking local.

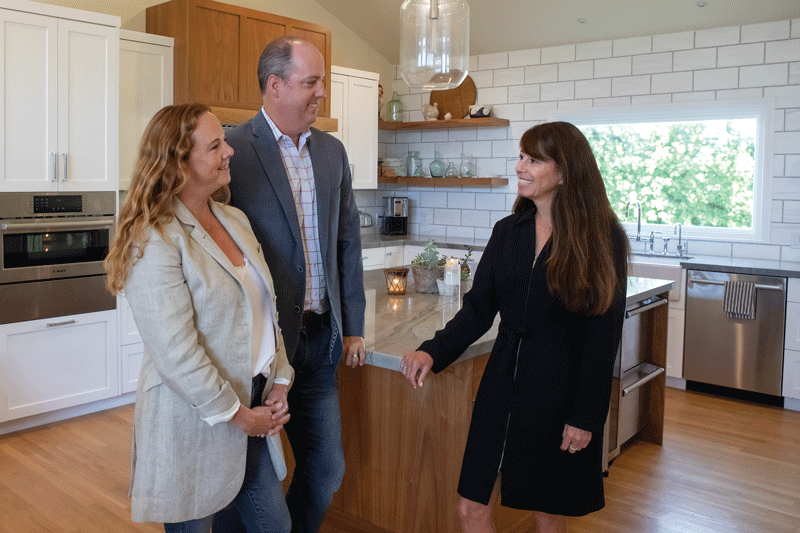

While FinTech platforms have undoubtedly revolutionized the banking industry, they lack the engagement and human connection that is core to community banks. Unlike FinTech platforms, where interactions are predominantly digital, community banks offer face-to-face interactions and informative conversations with knowledgeable staff members.

By prioritizing personal relationships, community banks strive to understand customers’ financial needs and deliver tailored solutions. This relationship-centric approach fosters trust and reliability, assuring customers that their financial well-being is of utmost importance.

In contrast, while FinTech services may be convenient, concerns regarding security and data privacy are valid, especially in an era where data breaches and cyber threats are pervasive. Community banks emphasize safeguarding customer information and providing a secure banking environment, while also offering conveniences typically associated only with FinTech. They implement robust security measures and privacy policies, creating a sense of trust and peace of mind that is difficult to attain solely in the digital realm.

American Riviera Bank is an FDIC-insured depository institution. While non-banking payment apps may have a certain appeal, claiming ease of money transfer or increased speed to pay retailers and friends or family, they are merely a storage mechanism for retaining funds. Unlike traditional bank and credit union accounts which have deposit insurance, funds stored in these nonbank payment companies may be unprotected as was highlighted by the Consumer Financial Protection Bureau in June when they issued a notice to consumers advising them to transfer balances to insured banks and credit unions. The CFPB also warns that payment app companies do not necessarily store customer funds in an insured account through a business arrangement with a bank or credit union. The company’s investments carry risk and if it were to fail, customers could lose their funds.

There are even companies out there that are misleading clients into thinking their deposits are insured when they are not. In fact, the FDIC has taken several steps against crypto and fintech companies demanding they cease and desist making misleading statements about deposit insurance status. On July 28, 2022, the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve System Board of Governors (FRB) issued a joint letter to Voyager Digital, LLC, a cryptocurrency brokerage firm, demanding that it cease and desist from making false and misleading statements about their deposit insurance status, in violation of Section 18(a)(4) of the Federal Deposit Insurance Act (FDI Act). In February 2023, the FDIC issued another letter to Zera Financial, noting they had reason to believe that Zera had made “false and misleading statements, directly or by implication, concerning Zera’s deposit insurance status”. Similar letters were sent to marketing firms, captainaltcoin.com and banklesstimes.com, requiring immediate corrective action to remove the misleading statements.

As financial literacy becomes increasingly important, community banks serve their customers by taking on the role of educators. With the understanding that customers may not have the same level of financial expertise or access to resources, community banks offer educational programs, articles, workshops, and seminars. These initiatives are designed to equip customers with the knowledge and tools necessary to make infor

med financial decisions. Customers are encouraged to ask questions, and are able to gain valuable insights from seasoned professionals. By providing educational opportunities and facilitating engagement with industry experts, community banks help individuals understand financial complexity and improve their financial literacy.

Another advantage of community banks lies in their local expertise and commitment to supporting the local economy. With deep roots in the regions they serve, community banks have an understanding of the unique financial challenges and opportunities faced by individuals and businesses in the area.

Whether it’s having insight into the local real estate market, understanding small business financing options, or identifying promising investment opportunities within the community, community banks possess knowledge that enables them to offer specialized services and products that truly cater to the specific needs and financial goals of their customers. Moreover, community banks demonstrate their dedication to the growth and development of local economies.

At American Riviera Bank, for example, we vow to keep customer deposits within the local community. Deposits are used as loans to you, your neighbors, and local small businesses, playing a significant role in supporting the local economy. Community banks help local economies thrive, and encourage vibrant communities. The direct impact that community banks have on local economies is a characteristic that sets them apart from FinTech platforms. Because FinTech platforms operate on a national or global scale, and provide digital financial services to a much larger customer base, they are not as invested in local economies as community banks are. They have limited relationships with local businesses, and are not as ingrained in the communities they serve.

Fintechs may also not be subject to the same consumer protection regulations as banks. This can create an issue when you are disputing a transaction, or looking to transfer or access your funds. While FinTechs may be partnering with financial institutions on higher-yielding solutions for storing your money, customer service is not what you’re used to with your local community bank. For example, Apple launched a high-yield savings account with an APY of 4.15% in partnership with Goldman Sachs in April, but there are several reports of difficulties transferring the money to their existing bank accounts according to media sources such as the Wall Street Journal, and the New York Post.

There are also reports of other issues related to money transfers, where the funds seemingly disappeared in cyberspace, and didn’t show up in customers’ Apple account nor the account they were trying to transfer the money to. The New York Post article indicates that an Apple Community Thread regarding difficulties in accessing accounts noted, “…Apple Savings representative “told me if the withdrawal is not successful by the 6th or 7th business day it will reverse and put the money back into your Apple Savings account. I’m hoping this is true and will wait another couple days.”

While FinTech platforms boast accessibility and efficiency, there are certain benefits of community banking that cannot be achieved digitally. Community banks are vital pillars of local economies, prioritizing local investment, providing personalized services, building relationships with customers and local businesses, and contributing to the success of the community as a whole. American Riviera Bank exemplifies the value of community banking by providing exceptional banking services to customers, as well as contributing to the growth of our community.