As the school year kicks off, now is the perfect time to think about how to help kids build smart money habits. From saving allowance to spending wisely, financial skills develop gradually—and often start at home. Small lessons now help create strong financial foundations later. If you're interested in how these habits grow over time, our earlier post on teaching children about money offers age-specific tips for introducing financial concepts.

From high-interest savings to service charge-free student checking to building credit, American Riviera Bank offers services to help your child save and spend wisely.

For children, the concept of saving money can feel abstract—until they see it grow. That’s the idea behind our special, high interest Kids Savings Account, available for children and grandchildren of account holders, ages 0 to 17. Whether you use this account to save for college or as a place to deposit allowance, gifted money or money earned by your child, you can use the quarterly statement to show how interest grows.

Our Kids Savings Account stands out with one of the highest interest rates available, making it one of the most rewarding ways for kids to learn about money.

The Kids Savings Account must be opened at one of our branches with a parent or guardian, creating an opportunity to start having financial conversations with your child like financial responsibility, fraud prevention, and balancing saving and spending.

You might also consider requesting a debit card to make accessing funds easy - we print them in-branch at the time you request them so they have something tangible to take home with them after opening their account. You can add card controls and alerts to protect them from fraud and add additional ID Theft protection – all at no charge.

As teens step into their first jobs, managing money becomes a key life skill. American Riviera Bank’s Simply Checking account helps make that transition smoother with features designed for young adults:

Simply Checking is certified by Bank On, meeting national standards for safe, affordable banking. It’s designed to help young adults manage money confidently, with features that prevent common mistakes like overdrafts and hidden fees. Digital tools make it easy to stay on top of spending, while built-in safeguards offer peace of mind for parents. It’s a practical, balanced account for students learning to handle their finances for the first time.

Establishing credit is key to long-term financial success. A good credit history can lead to future milestones, like buying a first car or getting approved for a first apartment. The key to earning a good credit score is consistent, positive habits, like paying bills on time. One way to establish credit is through the responsible use of a credit card, The primary goal is to build credit history by making purchases within their means and paying their bills on time consistently.

American Riviera Bank offers two tailored credit card options2. designed for young adults just starting out. Choosing the right first credit card can make all the difference. With built-in safeguards and tools like fraud protection and free credit score access, these cards give your student a secure way to start building credit.

As your child begins managing their own money, having the right digital tools can make all the difference. That’s why American Riviera Bank offers features designed to help students track spending, stay safe, and learn financial independence, with tools to support them and give parents peace of mind.

Depositing that first paycheck has never been easier than with Mobile Deposit. Located within ARB’s mobile app, Mobile Deposit is a quick and easy way to deposit checks without going to a branch or ATM.

Whether it’s splitting lunch with friends or getting a quick transfer from home, Zelle® makes sending and receiving money fast and simple. Available directly within ARB’s mobile app, it’s a convenient way for your student to manage everyday transactions without needing cash or checks.

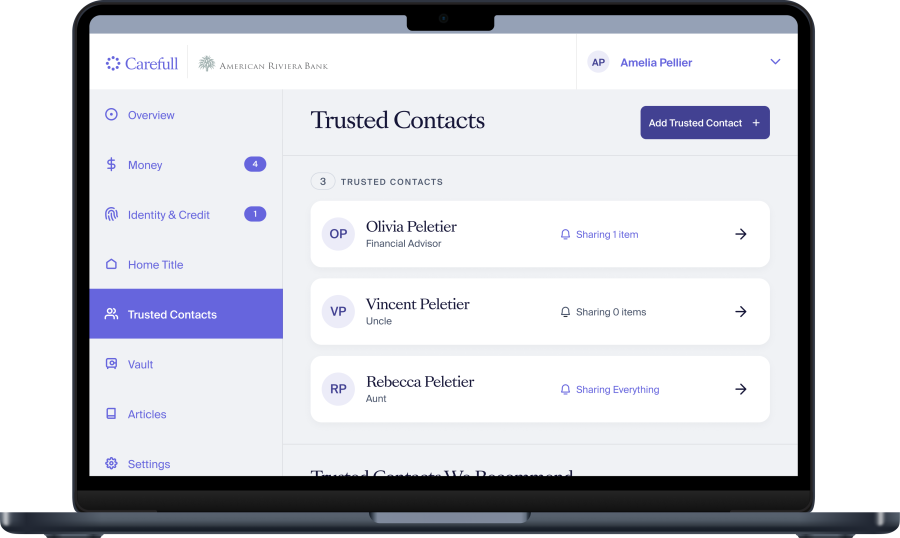

We’re proud to offer Carefull, a financial safety service designed to protect against fraud and identity theft. It monitors accounts 24/7, alerts users to unusual activity, and includes identity theft insurance—all at no cost to ARB clients.

Parents can be added as Trusted Contacts, giving them view-only access to account activity and alerts to help monitor for unusual transactions and support their child’s financial safety.

ARB’s Personal Finance tool helps young adults understand their spending and plan for the future. Tracking spending across accounts, categorizing transactions, and visualizing budgets helps students understand where their money goes and how to manage it wisely. Personal Finance is available at no cost within online and mobile banking. They can include accounts at other financial institutions, including credit cards, to see a full financial picture.

ARB’s Digital Banking tools are there for your child offering flexibility, protection, and insight as they take on more financial responsibility. It’s all part of our commitment to helping the next generation build financial literacy.

Financial literacy can start at any age – you don’t have to wait. With the right tools, your child can begin building smart money habits today—whether they’re learning to save, managing a first paycheck, or starting to build credit. American Riviera Bank is committed to raising a financially literate next generation. You can find additional information and helpful tips in the Financial Wellness section of our Financial Education page. Visit your nearest branch to explore which accounts and services are the right fit for your child’s financial journey.

Member FDIC

1 APY (Annual Percentage Yield) information is accurate as of March 1, 2025 and is subject to change at any time. Fees may reduce earnings. See additional terms and conditions governing deposit accounts in the Deposit Account Agreement and Schedule of Fees and Charges included in your new account materials. No minimum deposit to open; however, 10.00% APY will only apply to balances of up to $500.

2 The creditor and issuer of these cards is Elan Financial Services, pursuant to separate licenses from Visa U.S.A. Inc., and Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.